What effect will the outcome of the US election have on Private Equity?

- Kasper

- Nov 5, 2024

- 3 min read

This was the very timely and pointed question to the panel on ‘The Current Opportunities and Challenges in Private Equity’ at last week’s excellent Zero One Hundred Conferences in Milan.

It also reminded me of a similar question I received from several LPs just after the election of Donald Trump in November 2015.

Private markets is a long-term asset class

Was my somewhat simplistic answer, to which I added, "If a fund was late in its life cycle, returns would be all but baked in, or if it was still early in the life of the fund, the asset class would outlast even a two term president".

I did also add, that the asset class had time and again proven adaptable and resilient and had a proven ability to thrive not least in times of uncertainty. And furthermore that Republicans traditionally had been pro business which had benefited the industry.

As it happens the economic policies, even allowing for a quasi trade war with China, were on the whole, I think, beneficial for the industry, which also, even if also a beneficiary of public support, weathered the Covid years. In fact, many funds invested in this period of time look set to perform well.

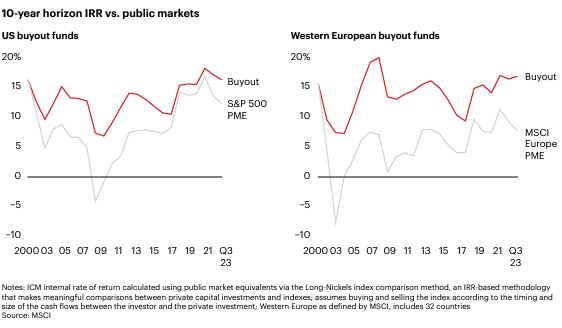

Buyout performance 2000 - 2023, US and Western Europe

Source: Bain & Co. Global Private Equity Report 2024

But what of today?

The panel, excellently moderated by Balentic’s Senior Advisor Chiara Orlandini, had a much more considered and eloquent answer than I did back in 2015.

Overall the view, also backed by data, was the election of a Democrat or a Republican had historically had little notable effect on private markets. But it was also pointed out that the policies of the two candidates today do differ substantially and that for example green’ industries would in the case of a Democratic victory likely benefit, which would likely not be the case with a Republican victory.

Protectionism would also in both cases likely go up. More so with a Republican victory, though likely not to the extremes mentioned on the campaign trail. In return, and also as an answer to another question to the panel, GPs and industry in Europe in general should probably be thinking about building manufacturing capacity in the US or risk significant tariffs and erosion of competitiveness.

I think this topic alone would have merited a longer more thorough discussion. But unfortunately the panel was running out of time.

So for my own account, also drawing upon discussions on other panels, I would add the following, which is worth considering for LPs and GPs

Larger allocators have increased their focus on their home regions

Profligate policies, whehter of the left or the right, will inevitably lead to inflation, which all else equal will lead to renewed rate increases - be weary of the use of leverage, not least as it has 'snuck' in at many levels

Protectionism, tariffs, and the like is not good for business, and GPs would do well to plan ahead for this

It is clear the days of easy returns are over

This very likely for good, and should, if not already the case, should prompt LPs to

Critically examine and triage their portfolios - giving some serious thought to what they might not want to be ‘stuck’ with and instead, no matter how poor, lock in performance now

Double down on manager selection - likely the performance of the 3rd and 4th quartile will be poorer going forward and which will increase return dispersion, something that I expect to be further exacerbated by the top quartiles performing even better

Portfolio construction is always critical but especially so in times of high uncertainty. Now is the time to look at risk factors ensuring good diversification and building a portfolio that can weather a storm.

Doing this necessitates substantial resources from LPs, particularly in terms of thoroughly screening a larger portion of the investment landscape to identify and eliminate underperforming managers, while also aiming to select managers with the potential to outperform in the coming decade.

Balentic is here to help

Unfortunately, most LPs do not have the resources to manually screen their portfolios let alone global private markets nor do they have the high quality data and tools to do this more efficiently.

To help LPs with this, I have for the past almost two years been busy building Balentic, which is also what kept me from my blog, where we with out platform Orca are increasing the efficiency for both GPs and LPs, while at the same time creating some much needed transparency.

With Orca is up and running, I now have a bit more time and I with that I expect to be able to blog a bit more regularly again.

Have a great election day.

Stay Illiquid

Kasper

Comentarios