391 unicorns and counting!

- Kasper

- Aug 20, 2019

- 3 min read

Updated: Oct 3, 2019

“A unicorn, a unicorn! My kingdom for a unicorn!”

Adapted from William Shakespeare, Richard III

Had Shakespeare lived today, I am pretty sure that’s what Richard III would have said.

Since Aileen Lee, of Cowboy Ventures, coined the term in 2013, these startups with billion dollar plus valuations have gone from, like their mythological namesakes, somewhat of a rarity to traveling in herds.

So far this year another 85 unicorns already been minted.

You can you invest in unicorns, or can’t you?

Obviously yes – there are currently almost 400 unicorns, not counting exits, and someone invested.

A slightly more nuanced answers is yes, but it’s not quite that simple.

Here are three options for trying to invest in unicorns

If you can “get in” when the valuation hits soonicorn or unicorn valuation. However, this mostly requires that you have invested in previous rounds or bring something other than money to the table. This could be domain expertise, networks etc. But at this point, when the value is evident to all, money alone is rarely enough!

Investing in very early stage companies, well before the valuations begin to pop, is another option. However, bear in mind that not even the most audacious venture investors would claim to be unicorn investors. This option is like to trying to pick a winning lottery ticket!

You can invest in a venture fund. While maybe not the same upside, probably a greater overall chance of a unicorn, significantly less risk of loss, and an overall better risk-return.

None of these options guarantees a unicorn. But for a venture investor a unicorn is simply a ‘headline’. Instead, it is about the actual money multiple and cash-on-cash return, which is not simply a function of overall valuation – no matter how high.

I discuss investing in unicorns at greater length in this article in the Singapore Straits Times, and will return to it in more detail in a future post.

A stampede of unicorns at eye-watering valuations

According to CB Insights, a research firm, there are currently 391 unicorns with a total value of USD 1.2 trillion – an average of around USD 3.1bn a piece. See the whole list here.

Notably, these figures don’t include the exited unicorns of which there have recently been quite a few – including more prominent ones such as Slack, Lyft, Uber, and more. Of course for investors it is great to see some unicorns also exit.

Figure 1: Global count of unicorns and valuations

Source, PE Compass August 2019, data from CB Insights as of August 2019

Of all these unicorns the decacorns alone, of which here are currently 21 – 5% of total, account for a staggering USD 457bn or 38% of the total value.

The youngest decacorn is Beike Zhaofang, a Chinese online real estate platform, which just ‘nosed’ past the USD 10bn ‘post’ in July.

The unicorn with the largest valuation is Bytedance, a Chinese AI company best known for its news aggregator Toutiao aka. TikTok, at a mindboggling USD 75bn. Another round for Bytedance will surely see it reach hectocorn status.

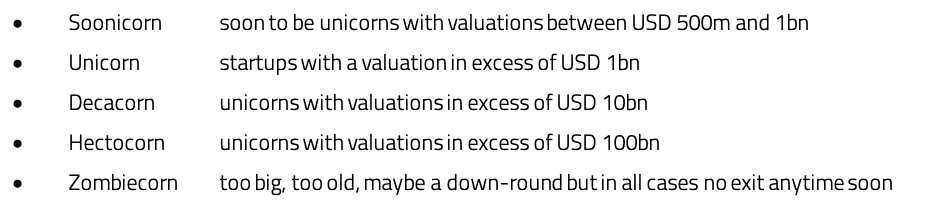

Beyond unicorns – decacorns, hectocorns, and…

With so many unicorns almost inevitably a whole taxonomy, as seen above, has evolved. Of course we might as well have called them red unicorns, blue unicorns etc. But, for now at least this is the classification.

Exhibit 1: the unicorn taxonomy

Source: PE Compass, August 2019

Gigacorns, anyone?

More on unicorns in the next post.

Stay illiquid!

Kasper

Sources: CB Insights, August 2019, PitchBook, June 2019 , The Straits Times, November 2018.

Comentarios